Transform Your Invoicing into a Fully Automated, Compliant Workflow

Why Do You Need an ERP Integration Platform?

If your business processes hundreds or thousands of invoices per month, manually handling documents or relying on inconsistent formats can lead to delays, compliance issues, and integration nightmares.

That’s where our ERP Integration Platform comes in — acting as a universal translator between your system and global e-invoicing standards.

What Does It Do?

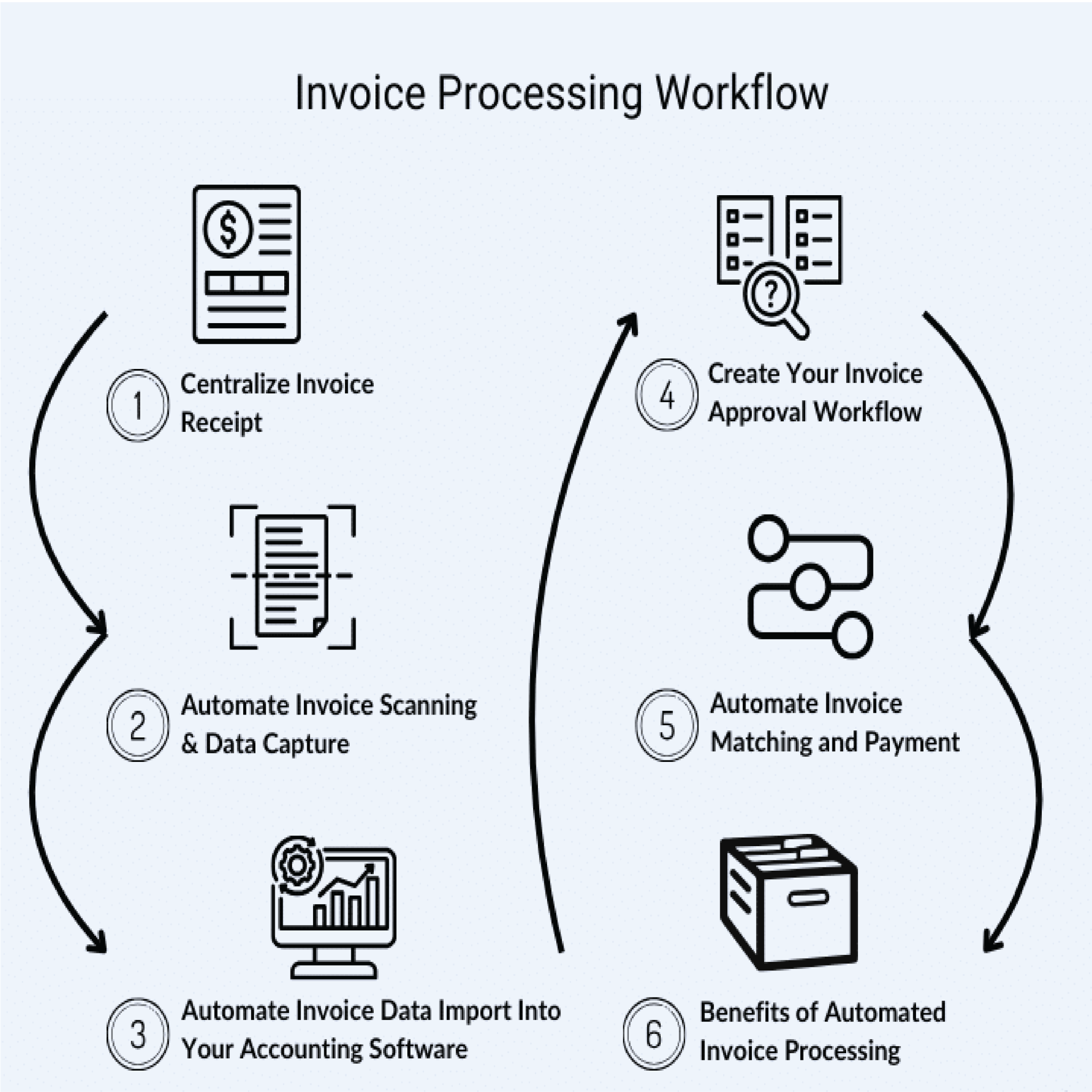

Our platform enables your ERP to automatically send, receive, and process e-invoices and related documents by:

- 🧾 Converting documents from global standards like UBL, EDIFACT, or XML to formats required by local authorities

- 🔍 Validating documents against both international schemas and country-specific rules

- ✍️ Digitally signing documents to meet legal archiving and tax authority requirements

- 🗂️ Archiving for compliance with local retention laws

- 🚨 Tracking errors and rejections in real time

- 📊 Logging and status monitoring for every transaction

Whether you’re working with Germany’s XRechnung, Italy’s FatturaPA, or any other national framework, the platform ensures your documents are always correct, complete, and compliant.

Who Is This For?

This platform is designed for:

→ We provide plug-in modules or API connectors tailored to your system.

→ Centralize invoicing across countries with one unified integration point.

→ Ensure every invoice meets local tax authority regulations — automatically.

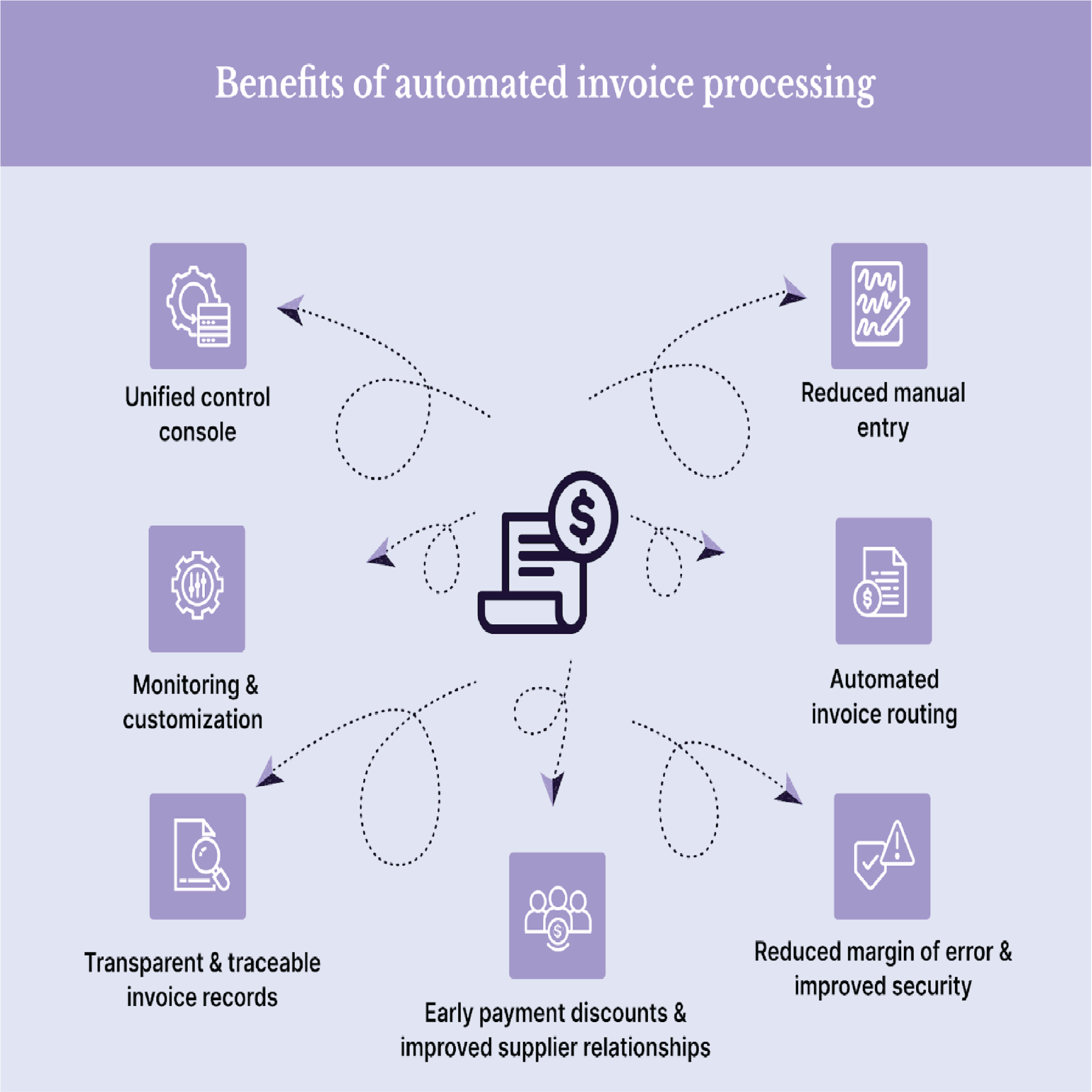

Business Benefits

Feature | Value for Your Team |

🌍 Global Format Coverage | One platform for all standards: UBL, EDIFACT, national specs |

🧠 Smart Mapping & Routing | Adapts to partner/country-specific rules instantly |

🕓 Real-Time Status Tracking | Know exactly when and where your invoice is — or if it fails |

🔐 Regulatory Compliance | Meet e-archiving, e-signature, and validation needs automatically |

🧩 ERP Integration Ready | Plug-and-play connectors for major ERP systems |

Contact

- Velodroomstraat 182 2850 Belgium

-

+32 456735966

- info@eaglessoft.com